Jaguar PLC, 1984 Harvard Business Review

Objectives

- To discuss operating exposure to real exchange rate changes

- To discuss various alternatives for managing such exposure

- This case setting is the privatization of Jaguar in 1984

- To value the shares being offered for sale as a function of expected exchange rate

Questions

1. Consider Jaguar’s exchange rate exposures. To which currencies is Jaguar exposed? What are the sources of these exposures? How would the company be affected by a 25% decline in the value of the dollar?

2. How should Jaguar’s shares be priced? Estimate the likely value of Jaguar’s equity in the following scenarios:

- no change in the real exchange rate between the dollar and the pound

- a 25% drop in the real value of the dollar against the pound

- a 10% rise in the real value of the dollar against the pound

- Create other scenarios of your own. In doing so, consider reasonable changes in price, volume, and other variables that may change as a direct or indirect result of exchange rate changes

3.Quantify Jaguar’s exposure in 1984 to the real dollar/sterling exchange rate. How large is it compared to Jaguar’s sales? Assets? Equity value?

4. Should Jaguar attempt to hedge its dollar exposure? Why or why not? What methods are available for hedging this exposure? What are the costs and benefits of each?

Background-dramatic turnaround from 1980 to 1983

- An increase in labor productivity

- Cost cuts

- An increase in volume to move the company past its breakeven production volume

- Sales volume increased by 13 thousand vehicles from 1980-1983.

- Nearly all of this improvement occurred in the U.S. market

What is the most important factor contributing to this increase in U.S. sales volume?

- Was it due to the appreciation of the dollar during this period (see Exh 7), rather than to the efforts of John Egan?

- Perhaps because of strong dollar

- But, both Jaguar and German competitors did not cut dollar prices in the US

- Instead, the followings contribute to sales volume increase rather than price cuts

1. Improvements in product quality

2. U.S distribution

3. Customer service

Q. Why did export volume to some countries such as West Germany and the rest of Europe actually declined from 1980 to 1983?

-It was not because of reduced European demand, but rather of Jaguar’s decision to allocate production to the more profitable U.S. market

Q. Which currencies affect Jaguar’s operating exposure?

- $/pound

- DM/$

- Daimler-Benz – Jaguar’s competitor

- Best: $/pound and DM/$ fall

- Worst: $/pound and DM/$ rise

- If we sell our products in the US but outsource from our home country, we will raise dollar prices after a weakening of the $ against home currency.

Valuation

- Base case

- A 25% depreciation of the $ against the pound, with no changes in $ prices or U.S. unit volume

- A 25% depreciation of the $, to which Jaguar responds with a 10% increase in $ prices Reduce U.S. unit volume

- A 10% dollar appreciation with no price or volume changes

1. Base case

- There are three types of distinctions

1. dollars vs. pounds

2. volume changes vs. price changes

3. fixed vs. variable costs

We divide Jaguar’s world into 2 markets, the U.S. and the rest of the world assumed to be a sterling market

Thus, the analysis may ultimately understate $ exposure, because markets such as Australia and Canada might be more $-like than pound-like.

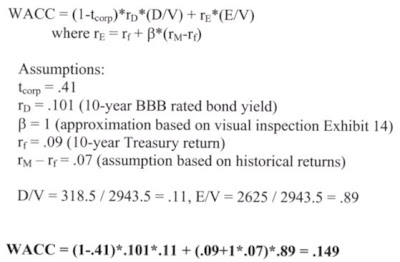

What is a discount rate for sterling cash flows?

- No beta is provided because there are no public shares as yet.

- Betas for other auto producers are either not available or are for very large full line producers such as G.M. and Ford,and are measured with respect to different equity markets.

Taxes

- Jaguar’s financial statements for 1980-83 show negligible taxes, but you may expect that Jaguar will soon exhaust its unutilized tax credits and carry-forwards.

- Dollar price increases in the U.S. equal to U.S. inflation, assumed to be 3% per year.

- Sterling inflation is 5% per year

- Rest-of-world sterling prices increase at this rate

Assumption

The exchange rate starts at $1.350/pound in 1984 (given in the case)

Declines at a rate of 2% per year (according to PPP)

This is not what the market expect.

Exh. 8 shows the dollar at a forward discount to the pound, despite lower U.S. inflation

COGS –variable cost increasing at the sterling rate of inflation.

Depreciation – fixed

R&D, distribution, and administration - increased with sterling inflation

Some portion of distribution costs is variable

Some portion of COGS, other than depreciation, is fixed.

2. 25% depreciation in $ against pound PPP holds there after. Thus there is no change in the sterling discount rate

Assume Jaguar makes no change in its dollar prices in response to the shock Its scope for responding is affected by actions of other competitors.

If the sterling value of the dollar drops, not its mark value, then Jaguar may have difficulty raising dollar prices because its German competitors are less likely to.

The effect of this simple change is quite dramatic.

The value of the CF is reduced from 515 million pound to 119 million pound a reduction of 77%

How to respond?

Other scenerios

25% Depreciation in $ and raise $ price 10%

The value of FCF is 258 million pound compared to 119 if we don’t raise price.

10% Appreciation in $

33% increase in FCF and 38% increase in equity value compared to the base case

Potential exposure to the Yen

Honda, Toyota, and Nissan are expected to enter the U.S. luxury car market before the decade is out.

None has yet entered in 1984.

Yen/pound - the Japanese producers may enter the U.K. and European markets

Yen/$ - The pace and progress of the Japanese entry into the U.S. market.

If yen appreciates against $, how will it affect the profit of U.S. luxury car?

Will be less profitable for the Japanese companies

This is even more true in less expensive segments of the U.S. market, in which the Japanese firms already compete.

Thus, this appreciation of yen will hasten the move upscale by Honda, Toyota, and Nissan to the detriment of Jaguar and the German companies.

It might reduce the profit of U.S. luxury car.

How to estimate exposures?

There is a distinction between the exposure of firm value and the exposure of equity value.

What is exposure?

It is how home currency firm value change with respect to the 1% change of home/FX exchange rate.Thus, it is foreign currency unit.

Exchange rate change may not be permanent

It may take only 1-2 years

This exposure is based on unexpected change.

If the exchange rate rises in 1985, the stock market may regard it as a deviation from PPP, but not as a surprise.

Exchange rate +/-1% Cash flow change +/- 50 million pound 50*$1.35/pound = $67.5 million

Overestimated number

Why is 67.5 million an overestimate of exposure?

It takes no account of Jaguar’s ability to blunt the exposure with operating responses:

$ appreciate -> Raise $ price -> Decrease sales volume

It assumes that exchange rate change is permanent

In the volatile rate environment of the 1980s, a given real exchange rate shock might have both permanent and

temporary parts

Exposure to a temporary change occurs during a year or 2, rather than the PV of all future dollar CF

It assumes that the exchange rate change is unexpected.

The expected scenario is not the base case, but rather one in which PPP is not expected to hold.

If the exchange rate rises in 1985, the stock market may regard it as a deviation from PPP.

Why do we tend to overestimate exposure?

It is not a surprise.

The MV of Jaguar assets (and equity) has already been discounted for some expected drop in the value of the $

That’s why Jaguar’s equity value drops to 200 from 450 million

Info about expected future exchange rates is available from the term structure in the forward market

The case does not provide the term structure of FW market except in Exh 8.

If available, it would be another way to construct the projected exchange rates

Should we hedge?

Although Jaguar’s exposure is much less than $24 billion, it is still large

Quite possibly larger than equity value or asset value

Pros of hedging

Reduced volatility increases firm value

By reducing contracting costs

Firms can hedge more cheaply than investors

Because of lower transaction costs and better information

Investor can hedge for themselves if they want to

A hedging program may be expensive

Difficult to control

Set up potentially perverse incentives

Ultimately ineffective

Cons-Derivatives

1. The are nominal contracts that only work well when nominal exchange rate changes are highly correlated with real

changes.

This has been the case for most major exchange rates for most of the 1980s.

2. They can significantly distort reported financial results

3. Except for LT debt, they are not easily obtained for terms much beyond 24 months.

4. Jaguar’s exposure is so large that any effective hedge would be large compared to the rest of the firm

Jaguar’s CFO remarked that, for LT US$ debt functioned as an effective hedge,…

Jaguar would have to issue a huge amount (over US$1 billion), convert the proceeds to pound, and sit on the cash.

He felt this would intolerably distort Jaguar’s financial reports.

Use real hedges:

Sourcing policies

Manufacturing locations

Selling locations

John Eagan stated the importance of quality

Use of real hedges made the company successful so far in the 1980s.

What happened

At the end of July 1984, 177.88 million Jaguar shares (of a total 180 million shares) were offered.

At a price of 165 pence per share

Implied a market cap of 297 million pound.

The offer was oversubscribed

The shares traded up about 7% upon being first listed on Aug 10.

Selling $ forward 50-75% of the next 12 months

It would not nearly hedge all of Jaguar’s exposure, but would give the manager some time to respond to dramatic

currency swings.

$ rose for a short time after the share offering in July 1984, reaching $1.159/pound at the end of 1984; it did not peak

until the first Q of 1985.

$ began to fall in Feb 1985

In the spring of 1985, Jaguar executives felt that forward rates were attractive and pushed their rolling hedge out 24

months instead of 12 effectively locking in sterling rates through the spring of 1997

This proved quite prescient, as the dollar’s slide accelerated, until by the end of 1987.

Jaguar’s management was roundly praised

DM/pound was fairly stable

In 1988-89, some of the forward contracts lost money as the dollar recovered

Many employees were dissatisfied Labor negotiations were more difficult

Unable to hedge its exposure effectively

Jaguar remained competitive through improvements in its dealer network and production efficiencies

Capital expenditures were tripled from 1983-1987 to modernize manufacturing capacity and lower costs.

Ford acquired Jaguar at the end of October 1989 in buying the entire company for 1.6 billion pound (about $2.5 billion)

| Estimated Exchange Rate Risk | 90.0 | |

| Value | Risk as a % value | |

| Q1 1984 Sales | 143.3 | 15.7% |

| 1984 Sales Annualized | 573.2 | 15.7% |

| 1983 Sales | 472.6 | 19.0% |

| Fixed Assets | 119.0 | 75.6% |

| Current Assets | 130.5 | 69.0% |

| Total Assets | 249.5 | 36.1% |

| Equity | 125.0 | 72.0% |